Etched: Silicon Valley's Speedrun

A Novel Semiconductor Startup Fundraising Framework, Etched's Unconventional Approach, and a MatX Prediction

Etched, a Cupertino startup accelerating transformer model inference with their Sohu ASIC, recently secured a $120 million Series A investment.

If you haven’t heard of Etched yet, here’s their elevator pitch:

Etched is building AI chips that are hard-coded for individual model architectures. Our first product (Sohu) only supports transformers, but has an order of magnitude more throughput and lower latency than a B200. With Etched ASICs, you can build products that would be impossible with GPUs, like real-time video generation models and extremely deep chain-of-thought reasoning.

Etched and their investors are very clear about the bet they’re making. From Etched CEO Gavin Uberti’s interview with Ed Ludlow on "Bloomberg Technology"

We are taking a bet. Unlike every other company in the market, our chips can only run transformers. So if transformers change dramatically or go away, then we'll be in a bad place. But if we're right and transformers keep being the dominant way that A.I. models work, we’ll be the most performant chip on the market by an order of magnitude.

Disbelief

The industry response was understandably tepid when Etched announced its seed round in May 2023. After all, how could some kids with no semiconductor experience build inference chips to unseat Nvidia? And isn't it ridiculous to stake everything on a single AI model architecture, especially when the next AI breakthrough could be right around the corner?

Yet over the last 12 months, several favorable events occurred that made Etched’s mission seem possible.

Groq’s chips demonstrated a significantly better user experience than Nvidia.

Etched hired experienced engineers from companies including Intel, Broadcom, Tesla, Google, and Meta.

OpenAI and Google launched game-changing transformer-based multimodal models that understand different types of information beyond text including image, audio, and video.

OpenAI demonstrated Sora, a realistic transformer-based text-to-video generator.

The increasing prevalence and versatility of transformers and Etched's assembly of an experienced team have eased some fears. Yet skepticism still abounds.

Semiconductor Startups Are Default Dead

Regardless of Etched’s progress, industry veterans are still skeptical because semiconductor startups are “default dead.”

From Paul Graham’s essay Default Alive or Default Dead,

When I talk to a startup that's been operating for more than 8 or 9 months, the first thing I want to know is almost always the same. Assuming their expenses remain constant and their revenue growth is what it has been over the last several months, do they make it to profitability on the money they have left? Or to put it more dramatically, by default do they live or die?

Semiconductor startups reading this think, “Revenue growth in the first year? It must be nice to be a software company!”

Fabless semiconductor startups require years before any revenue, let alone projectable revenue growth. They are default dead and require substantial capital to get anywhere close to a sustainable business model.

Hardware Startup Fundraising

Investment Stages

Let's examine the fundraising landscape of semiconductor startups and the financial obstacles custom chip ventures encounter.

The Crunchbase data below provides a snapshot of fundraising activity for various recent semiconductor chip startups (data not independently verified).

The typical fabless design startup trajectory is:

(1) raise a few million dollars in an initial seed round to get started with the design and simulation of the chip to prove the technical feasibility of the idea, then

(2) raise multiple tens of millions with Series A/B rounds to develop the first working prototype chip and initial software (compilers, debuggers, SDKs). Use this to drum up customer interest and then

(3) raise hundreds of millions in late-stage funding to manufacture a production chip with an advanced process node to sell at scale, then

(4) access substantial capital through an IPO to continuously invest in R&D for the next generation of chips while generating revenue from the current generation

Let’s create a new framework for understanding semiconductor fundraising stages. We will call these stages

Concept Validation ($1M-$10M)

Market Preparation ($10M-$100M)

Commercial Scaling ($100M-$1B)

Sustainable Roadmap ($1B-$10B+)

In terms of sales, these stages translate to:

(1) Selling the Vision: Convincing investors and potential customers of the chip's potential based on promising simulation data.

(2) Selling the Performance: Demonstrating the prototype chip's superior capabilities through carefully selected benchmarks and performance metrics.

(3) Selling the Solution: Offering a market-ready product that addresses customer needs and delivers superior performance compared to existing solutions.

(4) Selling the Future: Building confidence and securing long-term partnerships by showcasing a roadmap of innovative products that will maintain a competitive edge.

The Difficult Journey Ahead

The skepticism of any new semiconductor startup is justified. Look back at that fundraising chart and consider:

Are any of these companies default alive?

Have any gained enough momentum to go public and secure a long-term product roadmap?

More broadly,

How many semiconductor startups, particularly custom logic chip ventures, have gone public in the past 20 years?

How are those companies doing now?

These questions expose the harsh reality of the fabless design startup landscape, where even the most promising ventures face daunting odds.

AI Gold Rush vs. Silicon Freeze

Note that the number of funding events per year for these particular companies has dried up, with only a trickle of investments occurring after 2022.

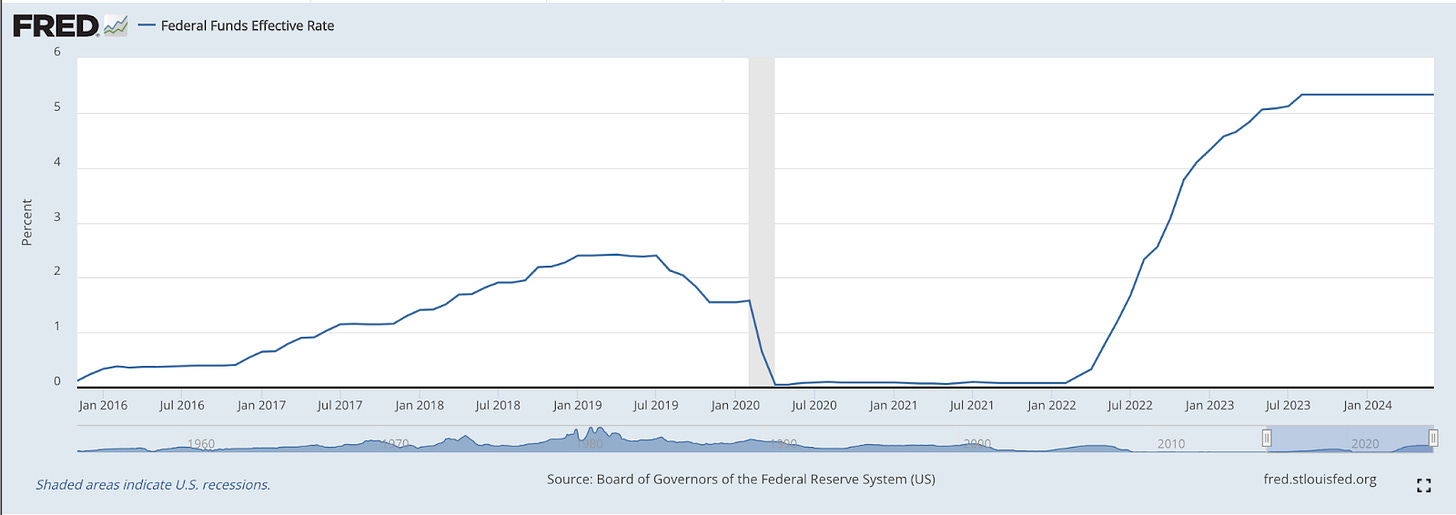

On one hand, this aligns with the current macroeconomic climate, where venture investors are becoming more cautious. Since 2022, borrowing costs have soared, making safe investments with high yields increasingly attractive.

On the other hand, this is the exact moment Generative AI is blowing up.

The gold rush shovel and pick merchant Nvidia is blowing up too.

Given the contrasting forces of the Gen AI boom and the current investment chill, the question looms: will semiconductor startup funding thaw out?

Etched's successful fundraising round suggests that some investors are indeed coming off the sidelines to support AI chip companies with the potential to create better picks and shovels for the AI gold rush.

Etched: Skipping Straight to Scale

Take a look at this chart again. Notice something about Etched—the size of their fundraising suggests they are skipping stages and jumping from the Concept Validation stage to the Commercial Scaling stage.

This makes a ton of sense. Etched doesn’t need to prepare the market.

Transformer-based inference is already in high demand, yet it is still too slow and expensive. There’s an appetite for someone other than Nvidia to solve this problem.

So why would Etched waste time with a prototype chip? This could set them back years and cause them to miss the opportunity entirely.

The substantial funding secured and the caliber of talent joining Etched strongly suggest that their initial design simulations met or exceeded expectations.

This confidence has likely led them to accelerate their path to commercial production, skipping a prototype stage and instead focusing on building and delivering servers tailored for cloud providers, AI companies, and enterprises.

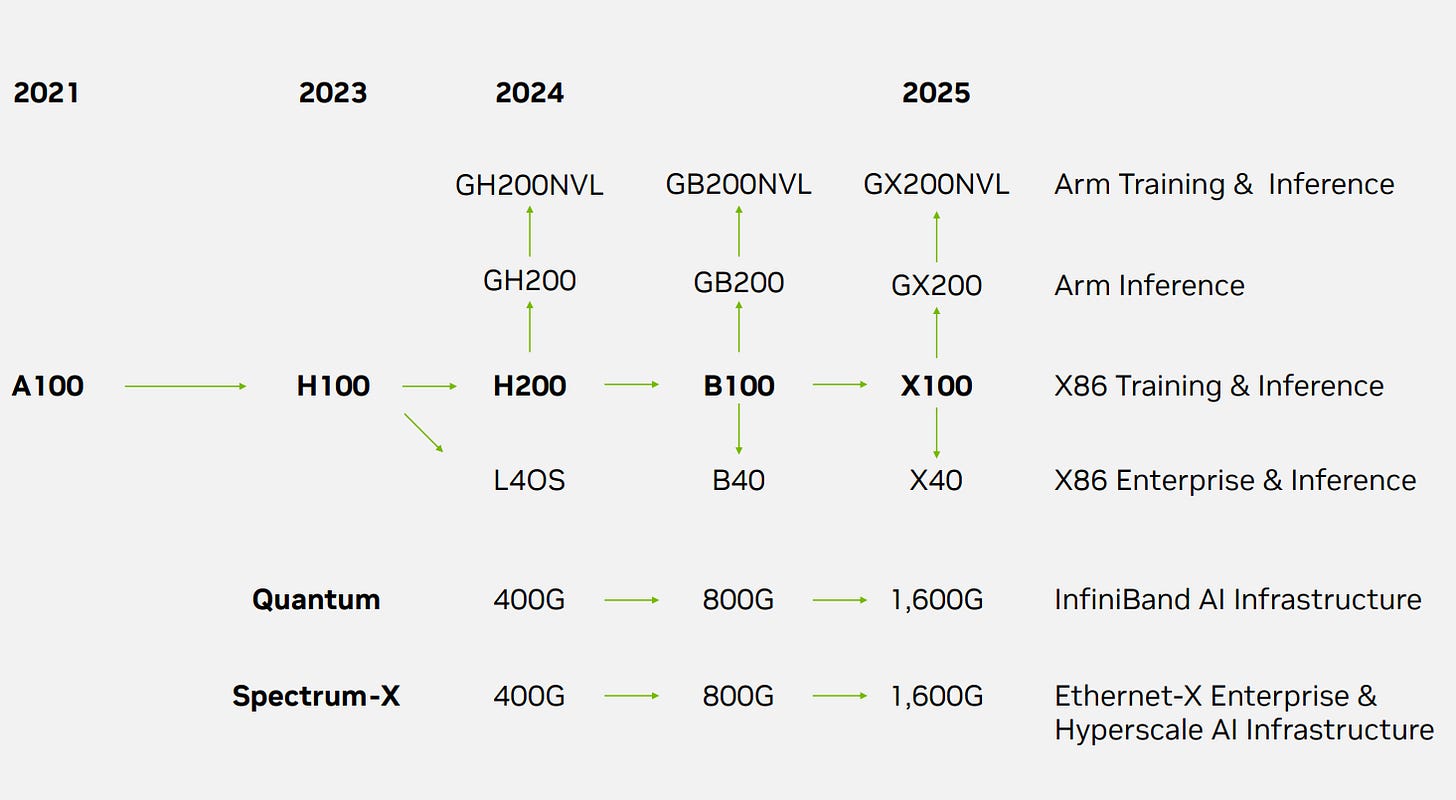

Competition is moving quickly in this space, yet another reason to speedrun.

MatX recently revealed that it is pursuing the exact same outcome of cheaper, faster inference with custom AI chips. Their announcement on X proclaims

Introducing MatX: we design hardware tailored for LLMs, to deliver an order of magnitude more computing power so AI labs can make their models an order of magnitude smarter.

SemiAnalysis suggests Groq is pushing toward the Commercial Scaling zone next year:

Furthermore, Groq is using a much older 14nm process technology and paying a sizable chip margin to Marvell. If Groq gets more funding and can ramp production of their next generation 4nm chip, coming in ~H2 2025, the economics could begin to change significantly.

Nvidia’s annual cadence will also continue to deliver improvements.

Etched is making a strategically sound decision to break from the traditional investment trajectory mold and jump straight to commercialization.

A MatX Prediction

Etched's approach could be paving a new path for AI chip startups. Consider MatX's substantial $25M concept validation raise. Given the current AI gold rush and competitive landscape, I anticipate MatX will also fast-track its path to commercialization. A follow-on investment of $100M+ in the next 12-18 months wouldn't be surprising.

More Questions

Let’s end with a few of the big questions.

Where’s the Proof?

Many skeptics view Etched with suspicion, questioning their legitimacy and wondering why they haven't disclosed their simulation results.

However, recall that the Concept Validation stage aims to prove technical feasibility, allowing the company to sell the vision to investors and potential customers. This information is kept strictly confidential; Etched doesn't want to give its competitors a leg up by revealing its successful approach and performance data.

For now, we eager observers will have to wait for concrete proof. Again, recent substantial investments and high-profile hires suggest Etched's simulations are indeed promising.

Yes, there's always the remote possibility of an elaborate ruse. We've seen that in recent Silicon Valley history, but it seems far-fetched in this instance.

Is $120M Enough For Commercialization?

I honestly don’t know. From this 2 hour wide-ranging discussion with John Coogan at Founder’s Fund, I get the sense that they think it’s enough.

To start, it sounds like they are working with TSMC and feel confident they are receiving fair pricing and allocation:

We worked directly with the the emerging businesses group at TSMC. That’s an offer we couldn't pass up. And, it's been a pleasure working with them. They are my favorite supplier by a good margin too. …

TSMC has been very fair for its entire history. It’s a privilege working with them. And for most of other suppliers, I can't say that. Most of them will nickel and dime you at every opportunity. You have to negotiate very hard. At TSMC, the price is the price.

This is again emphasized in Etched’s official announcement, along with a hint of a customer backlog and revenue that could help extend Etched’s runway

We’ve partnered directly with TSMC on their 4nm process.

We’ve secured enough HBM and server supply from top vendors to quickly ramp our first year of production.

Our early customers have reserved tens of millions of dollars of our hardware.

These quotes seem to suggest Etched believes they have enough runway to see through a production tape-out.

Can’t Nvidia or other big companies do this?

From the interview with John Coogan, Etched argues that Nvidia will make model-specific chips eventually, but not now.

Robert Wachen: So, you know, Nvidia has this huge innovator's dilemma where they're they just made over $20B last quarter on data center AI GPUs. Building anything that cannibalizes their revenue, whether that's an inference only H100, or a DLRM specific H100, or a transformer specific H100 — that would take away billions of dollars of revenue. So they're not gonna do this until they're forced to. I think we're gonna be the first by a few years to get this out in the market.

Furthermore, Etched asks why others like OpenAI would dare to take on this risk.

John Coogan: What about OpenAI, Anthropic, Meta? Why won't they build a transformer focused chip themselves?

Robert Wachen: Well they may be able to buy it from us!

John Coogan: Yeah, but why won't they do it themselves?

Gavin Uberti: I mean, eventually they will. We've talked to the folks that you’d expect. They know their next generation will be a transformer.

But they're not sure about GPT 6. That's risky [to make a transformer chip now if the future architecture is up in the air].

Traditional logic in the AI chip field suggest that you must carefully balance how many vector operations, how many scalar operators, how many tensor cores are needed to support any kind of workload.

If the models change, then every general purpose AI chip will be fine. If state-space models or Monarch mixture becomes the dominant paradigm, Nvidia and Google and OpenAI, and every other chip company on the market will be fine.

But not us. We are inherently taking a risk. This is a different kind of bet. If transformers go away, then we have no business anymore.

But if transformers stick around and keep being as dominant as they are today, Etched will be the largest company in the world.

Other Concerns

Etched is Making the Biggest Bet in AI answers other questions, including “Isn’t memory bandwidth the bottleneck?” and “What about your software?”. If you’ve made it this far, it’s worth the 5 minutes of your time.

Your Feedback

I’m interested in your feedback.

Do you have experience with semiconductor startup fundraising as an investor or startup? Send me an email or reach out on the Substack app, I’d love to hear your experiences and insights.

As always, thanks for reading.

If you enjoyed this, subscribe and share it with your friends.

To those of you in the United States, Happy Independence Day!