Qualcomm + Intel

The "Inference Everywhere" Angle

Qualcomm’s pursuit of Intel has jignited a public debate, and many rightly focus primarily on the downsides. What’s missing is a discussion on how this deal could position Qualcomm in an increasingly AI-dominated landscape. Let’s explore this angle together.

Assumptions

In the next 2-5 years, let’s assume that inference workloads

command the majority of AI computation

increasingly run at the edge

run on a variety of form factors

Inference Compute Increases

The rationale for #1 has traditionally been straightforward: consumers experience the value of Generative AI through inference. As LLM-powered products find market fit, the amount of daily inference will continue to climb.

Yet, in addition to the increase in the number of users relying on inference, OpenAI’s o1 reasoning model demonstrates a new era in which the amount of compute spent on inference now matters, too.

Jim Fan illustrates this nicely on Twitter.

Jim explains,

A huge amount of compute is shifted to serving inference instead of pre/post-training. LLMs are text-based simulators. By rolling out many possible strategies and scenarios in the simulator, the model will eventually converge to good solutions. The process is a well-studied problem like AlphaGo's monte carlo tree search (MCTS).

As product-market fit is found using o1-like models, we can expect inference compute demands to rapidly increase.

At The Edge

As a result, companies will increasingly be motivated to offload these workloads to the consumer’s devices as much as possible — consumers provide the hardware and electricity for companies to generate intelligence.

It’s win-win: Companies reduce CapEx and OpEx, while consumers get the benefits of local inference. It should be noted that adoption of local inference requires

Incentives for consumers (business models that reward local inference, security benefits, etc)

Useful small models that can fit on edge devices

The former seems straightforward.

Models like o1-mini make the latter approach increasingly realistic. I don't need Siri to be a compressed version of the entire web—just a reasoning tool that can manage simple tasks. What’s needed is more of a well-trained 5th grader than a PhD polymath.

Everywhere

LLMs open up hands-free applications by integrating a microphone, speaker, and an o1-like model, enabling any device to speak and reason in English. Why not add a camera for multimodal reasoning too!

LLMs will free us of the need to keep both eyes and one hand distracted with an iPhone while navigating the physical world.

Qualcomm + Intel

Edge

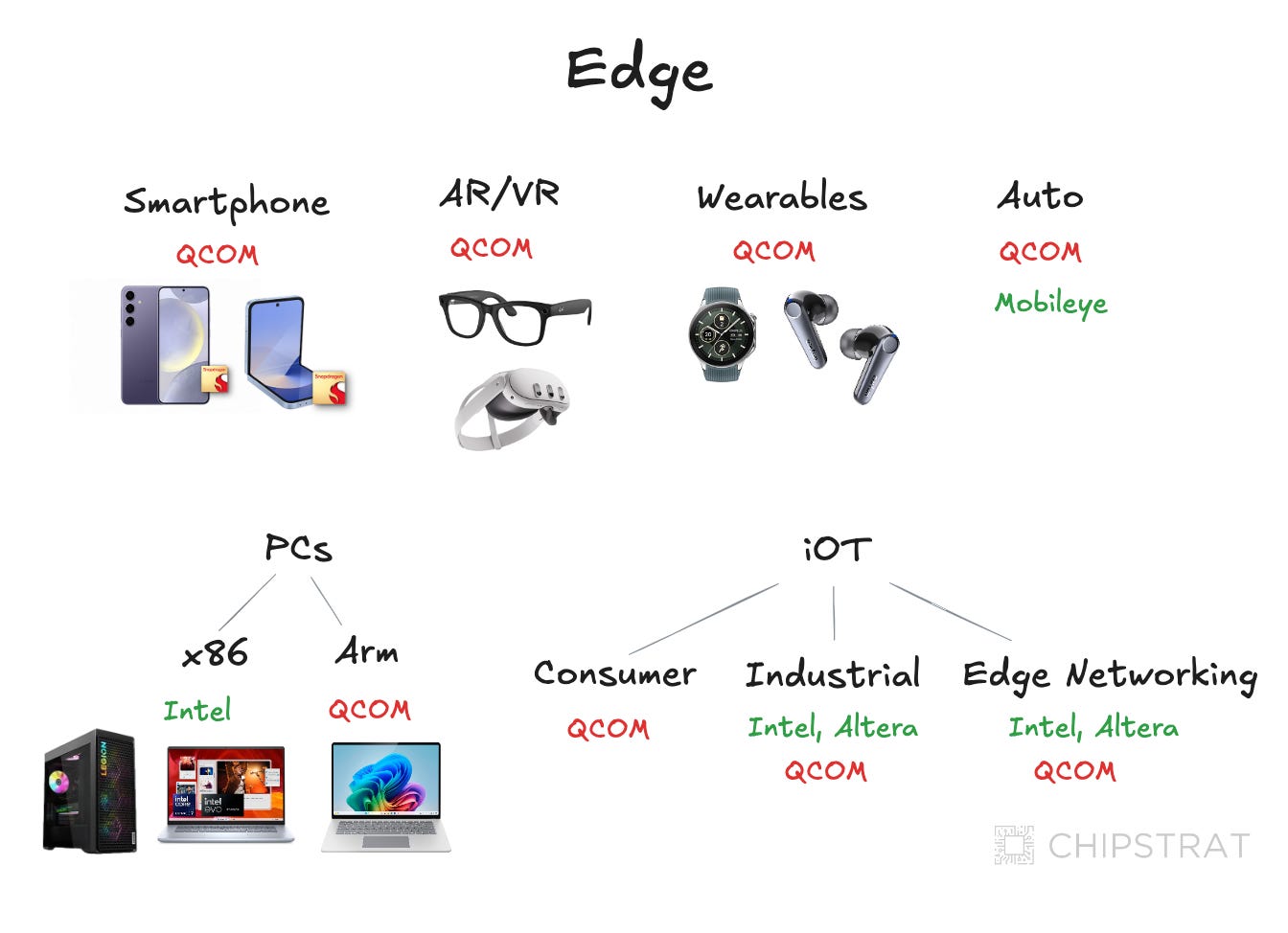

With this future in mind, Intel’s x86 laptop and PC strength would add a significant installed base and revenue to Qualcomm’s edge portfolio:

With the addition of Intel, Qualcomm would be well-positioned for the rise of inference on edge devices across a variety of form factors: smartphones, laptops and desktops, glasses (Ray-Ban Meta collaboration), automotive, VR (Oculus), watches, and more.

This edge portfolio would enable Qualcomm to meet consumers where they are today (smartphones, laptops, desktops) while positioning it for tomorrow (hands-free devices).

Additionally, Qualcomm would gain diversification in revenue streams. x86 PCs are cash cows that immediately provide diversified and stable revenue streams and could offset smartphone, automotive, and embedded market downturns.

This edge portfolio’s competitive advantages include x86 and wireless technology. Both have strong lock-in effects.

Qualcomm would likely remove some redundancy in this portfolio, such as choosing between the Snapdragon Ride Platform and Mobileye and whittling down any networking overlaps.

However, it would retain some seemingly competitive offerings, such as x86 and Arm-based PCs. X86 is a massive revenue source today.

Yes, x86 is at significant risk of losing share to Windows on Arm over the next decade, but this cannibalization would be acceptable for Qualcomm as the consumer’s dollars still end up in Qualcomm’s pocket.

The downside of owning both is increasing royalty payments to Arm as market shift happens, which would drag down overall margins. For this reason, Qualcomm may feel incentivized to slow its Arm PC product roadmap unless a different Arm competitor enters the fray. The incentive for Qualcomm to withhold or slow down Windows on Arm could cause regulatory concerns.

Data Center

While edge inference will become more prevalent, cloud inference will persist and expand. As the total volume increases, both edge and cloud workloads will see growth.

Nvidia dominates the cloud AI acceleration space, and AMD is increasingly competitive. Intel has Gaudi and maybe Falcon Shores, while Qualcomm has the Cloud AI 100 – none of these will take meaningful share from Nvidia and AMD.

Qualcomm can’t be everything to everyone, and its competitive advantages are edge-centric, so exiting the AI acceleration business entirely should be on the table.

Qualcomm’s data center business would inherit significant revenue from Intel’s Xeon servers running conventional workloads. Moreover, some AI workloads run on CPUs today, which won’t go away anytime soon. And there’s a bit of contribution from Intel as the head node of choice for Nvidia.

Qualcomm’s data center business could explore ramping up an Arm CPU server business targeting hyperscalers who have already switched or are considering switching from x86. Would hyperscalers give up their internally developed Arm-based servers? Maybe not, but it does raise the question of how many hyperscalers want to indefinitely fund their own internal silicon efforts.

Foundry

Intel Foundry can’t spin off until it diversifies its revenue stream; how many startups can IPO with only one customer? Ask Ampere and Oracle. Qualcomm would need to own Foundry for now.

The benefit to Foundry is increased volume from Qualcomm. This is very important for Intel Foundry. But it’s non-trivial for Qualcomm chips to be designed for an additional foundry process.

Yet Cristiano Ammon is very open to the trade-offs so he can reduce single-supplier risk. From Business Korea,

Cristiano Amon, CEO of the U.S. semiconductor company Qualcomm, has seriously considered collaborating with Samsung Electronics on their foundry services for semiconductor manufacturing.

“The current focus must be on the foundry production at TSMC, but it will likely require significant effort to have one company handle both aspects,” Amon stated. He welcomed collaboration with both TSMC and Samsung Electronics, indicating continued support for this approach.

Foundry’s primary aim would be to continue ramping up 18A and advancing 14A, with profitability and a spin-out in mind.

However, is Qualcomm capable of redesigning some products using Foundry’s 18A PDK swiftly enough to contribute to Foundry’s bottom line before it’s too late? Would Qualcomm’s volume benefit actually materialize?

As an aside, I would expect Pat Gelsinger to stay on as Foundry CEO through the spin-out and subsequent IPO.

Pros and Cons

This framing bets on an “inference everywhere” future. Qualcomm is already well-positioned to benefit from the shift away from PCs, especially with GenAI’s promise to increase the usefulness of hands-free devices. Yet the addition of x86 PCs gives Qualcomm upside if we see a rise in local PC inference in the coming years.

Whether PC inference manifests or not, Qualcomm gets a steady cash cow revenue flow from x86 PCs and servers, and this diversified revenue stream may cycle independently of other Qualcomm businesses like smartphones and automotive.

Honestly, forget the inference framing – this steady x86 revenue alone could be worth it. If the price is right, of course.

Theoretically, the foundry relationship is mutually beneficial, giving Qualcomm a second-source while helping fill Intel Foundry’s fabs. However, the timing of this benefit may not be immediate, and it seems complicated and risky to pull off. IDMs are risky, and Qualcomm doesn’t want to become one; they would definitely want to spin out Foundry ASAP.

One challenge: Intel’s client brand is already very strong, so Qualcomm should not mess around with it and put the x86 PC revenue at risk. Of course, this implies the Qualcomm brand won’t necessarily benefit from the Intel acquisition.

Closing

The “inference everywhere” is a new angle to the Qualcomm merger or acquisition of Intel that I hadn’t seen discussed publicly, so I wanted to think it through and share it with you all.

Honestly, it’s not necessarily any more compelling than any other angle I’ve heard so far 😅.

The opportunity to acquire Intel’s x86 cash cow PC and server business is compelling — especially if the price is right. And if there’s ever been a time for an Intel fire sale, it’s now.

But the hassle of taking on Foundry, funding it, and spinning it out doesn’t seem worth the risk.