Understanding Intel

Explaining Intel's Strategy, Recent Challenges, and Subsequent Strategy Shifts.

Last week's paid subscriber article explored the resurgence of logic chip startup funding in 2024, Groq’s series D, and the impact of geopolitics on Block's move into Bitcoin ASICs. This week, we’ll take a first-principles look at Intel’s business model as context to understand its bad quarter and surprising layoffs.

Ideal Models

Semiconductor businesses are complicated, especially when designing and manufacturing chips. However, we can distill Intel’s business model to core principles and still have a surprisingly robust understanding.

This approach is similar to that used in engineering school, where we use an ideal model to gain an intuitive understanding of how something works.

Take Ohm’s Law, V = IR. This simple equation explains how voltage (V), current (I), and resistance (R) are related. This ideal model gives a first-order approximation of reality. It ignores details like the temperature dependence of resistivity; notice that V = IR is not a function of temperature. These details that can be left out without significantly impacting the accuracy of the results are second-order effects, as they typically cause the final calculations to deviate only slightly.

The best ideal models are simple. Ohm’s law is shockingly simple.

At the microscopic level, the concept of current and resistance is complicated: A voltage applied across a conductor creates an electric field that causes free electrons within the material to move (current). This flow of electrons is impeded by various obstacles (resistance), including impurities in the material, vibrations of the atoms in the material, and even scattering from other electrons.

It would be natural to assume that a complicated model would be needed to truly describe the relationship between voltage, current, and resistance. Surely, we’d need to account for the amount of impurities and lattice vibrations in a given material, right?

The beauty of Ohm’s law is that we don’t need to understand all of the complexities at the microscopic level. Instead, we can live at the macroscopic level and develop an intuition for the behavior of a circuit with an elegant mental model that relies on nothing more than elementary math.

This same approach can also be applied to understanding business strategy. We can focus only on the major contributors to revenue and leave the other details for later. The mental model we’ll build can’t be easily empirically tested like Ohm’s law, but it will still help us intuitively understand the business.

Intel’s Business: Ideal Model

Let’s examine Intel’s business from the first principles to build a simple mental model. We’ll later use this model to make sense of Intel’s lousy quarter.

Design and Manufacturing

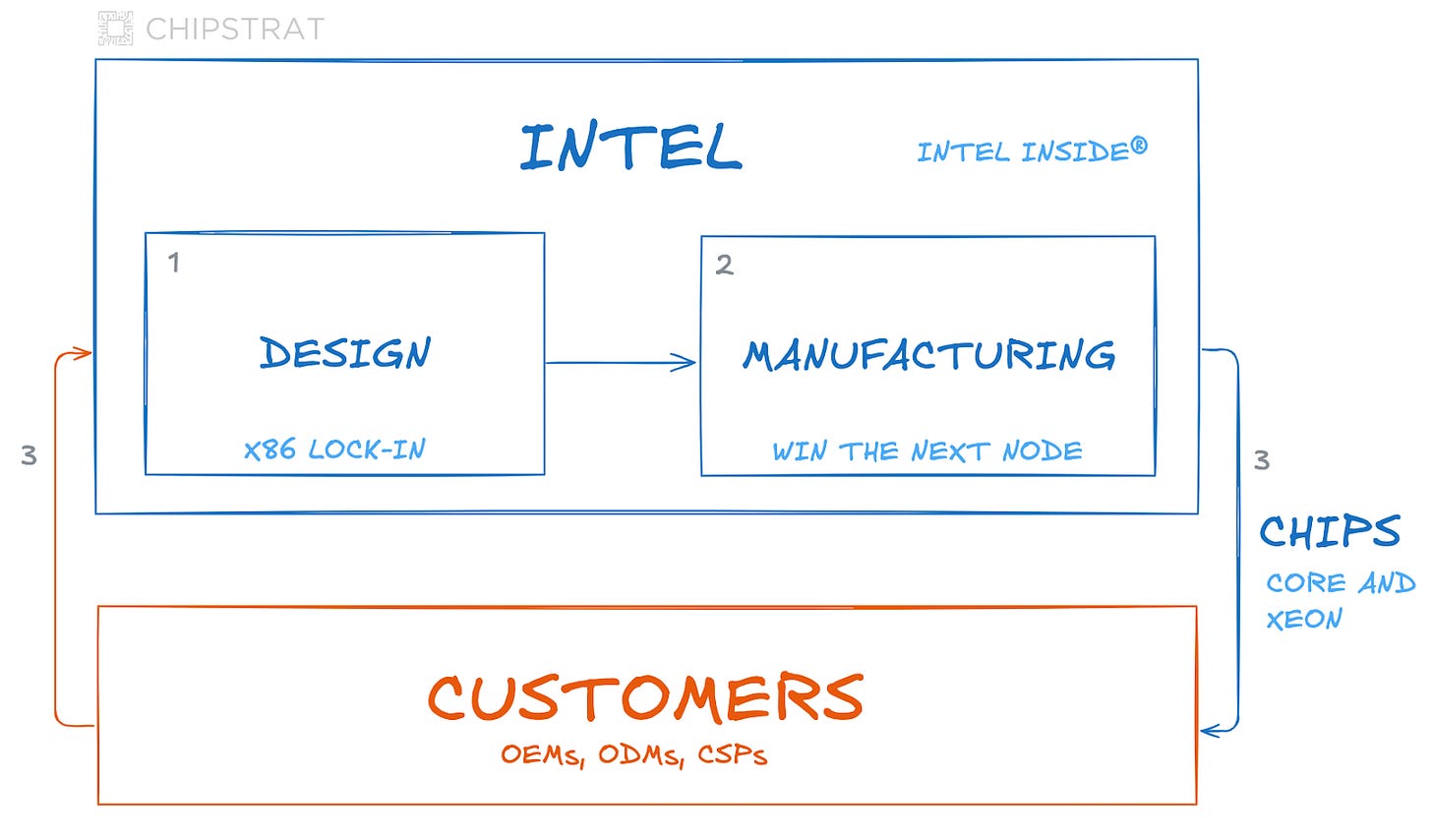

Intel's revenue comes from the sale of semiconductor chips, the majority of which are CPUs. This process entails two fundamental steps: the initial design phase and the subsequent manufacturing stage. Thus, we can think of Intel as two departments — a design group and a manufacturing arm.

Here’s a very simple model of Intel’s business:

Quick definitions: A company like Intel that designs and manufactures its chips is often called an Integrated Device Manufacturer (IDM).

Competitors like AMD are fabless semiconductor companies because they don’t operate their own semiconductor fabrication plant (fab). Instead, fabless chip designers use contract manufacturers (foundries) like TSMC to build the chip.

Business Units

While Intel has various business segments, our simple model will concentrate on the two core divisions that generate the most revenue: the Client Computing Group (CCG) and the Data Center and Artificial Intelligence (DCAI) group. Client makes chips for laptops and desktops, and data center makes chips for servers.

For now, Intel’s other business units, like NEX (networking and edge), can be considered second-order effects, as they account for less than 20% of revenue and have questionable growth prospects.

Simply put, if CCG or DCAI are unhealthy, Intel is unhealthy.

Product Lines

Intel’s two main businesses each have a single cash cow product line: Intel Core for clients and Intel Xeon in the data center.

Both product families offer a range of SKUs at different price points, with performance generally correlating to price. For instance, Core i9 represents the top-tier, high-performance option, while Core i7 provides slightly less performance at a more affordable price.

An interesting note: Semiconductor fabrication inherently yields a range of chip quality due to the random distribution of imperfections across a wafer. Intel cleverly capitalizes on this by designing every chip to be premium (e.g., Core i9), then testing and sorting them post-production into performance tiers (“binning”). Top-performing chips become the premium offerings, whereas those with imperfections and degraded performance are slotted into the midrange or lowest tiers. For the motivated reader, here’s a nice video containing a deeper dive:

We’ll update our mental model to note that most revenue is generated from the Core and Xeon product lines.

Yes, this is a super simplified model that ignores many details that are important for certain conversations. But again, Ohm’s law simplicity is the goal here.

Now let’s dive into the competitive advantages of Intel’s business.

Manufacturing

It’s worth discussing why Intel manufactures its products in-house, as it’s a key differentiating factor that has significant consequences for Intel.

Fab History

Back in the day, every chip company was an IDM—no contract manufacturer existed. From Fabless,

Fabs were not always so expensive, and most semiconductor companies owned their own fabs. In 1980, there were no semiconductor companies that didn’t own their own fabs to manufacture their own designs. However, the economics of fabs have completely changed the semiconductor ecosystem.

Look at the increasing cost of a semiconductor fab over the decades:

Notice the massive increases, for example costs increased by an order of magnitude in the 1980s. Over time this forced chip companies to shed their manufacturing teams.

It quickly became clear that only the largest semiconductor companies could afford to build a cost-competitive fab. It wasn’t just a matter of the investment required but also that there would be more capacity than they could use. Back when a fab cost $3 billion to build, a company would face a depreciation cost of roughly $1 billion per year, meaning that they needed to have a running semiconductor business of perhaps $5 billion, around the size of AMD, who was the only competitor to Intel in the x86 microprocessor business.

As the cost of entry increased, companies began pooling resources. We see this recounted in the annals of the web, like this 2007 article IBM chip alliance inks new pact for 32nm chips,

A group of chip makers led by IBM Corp. has agreed to further their collaboration by jointly developing 32-nanometer semiconductor production technology …

Freescale quickly moved in with the IBM group, a vote of confidence for its collaboration, which also includes Chartered Semiconductor Manufacturing Ltd., Infineon Technologies AG and Samsung Electronics Co. Ltd.

The escalating cost of chip development made it impossible for many companies to go it alone, and the number of companies with a leading-edge fab decreased.

Intel’s Fab Strategy

Intel has always retained its fab, considering it a key competitive advantage.

The rationale is simple: reaching the next process node before the competition unlocks a performance and power advantage for Intel’s design teams.

Fabless companies forfeit this edge, as they're constrained to the same process node as other foundry clients.

The following graphic demonstrates how smaller transistors empower chip designers to prioritize enhanced performance or reduced power consumption (or a bit of both!)

Having an internal manufacturing group offers secondary advantages such as control over chip quality, volume, and timing of production.

Betting Strategies For A Perpetual Horse Race

This perpetual race to the next process node resembles an industry-wide, never-ending horse race, in which companies bet on a (manufacturing) horse to reach the next process node first. The winning horse gets a significant share of the pot, and the cost of entry for each subsequent race increases significantly.

Most companies started by racing their own horses, but as the entry fee increased, they pulled their horses and started pooling their money for the buy-in.

Intel’s horse won race after race for many years. For example, see the race to 90nm:

Intel continued to win race after race:

Design and x86

While Intel's manufacturing capabilities significantly contributed to its success, the x86 ISA was also a strong competitive moat. Windows software was historically tied to x86 processors, making it incredibly difficult for competitors to gain traction in the Windows-dominated PC market.

Babbage sums it up nicely in The Paradox of x86.

Over five decades, x86 has been enormously successful. Billions of processors have been shipped using the x86 ISA, generating over a trillion dollars in revenue for Intel. In part that’s because consumers and businesses have needed to buy an x86 compatible PC in order to run first MS-DOS and then Windows software. More recently, x86 designs have become dominant on servers as Intel’s manufacturing prowess, supported by large volumes of PC sales, has enabled the company to create powerful designs that outperformed competitors.

Brand

Finally, Intel has another powerful differentiator: its brand.

Intel still benefits from its legendary “Intel Inside” marketing and co-branding campaign, which helped the general population associate Intel’s chips with performance and quality.

Intel’s masterstroke was incentivizing OEMs to participate in promoting Intel.

As Intel’s website recounts,

Where previous tech marketing had focused heavily on technical specifications designed to appeal to industry insiders, Intel Inside was designed to be accessible to laymen. It loaded a simple logo with enough meaning to give non-techies an easy way to understand that their devices contained quality components provided by the company that defined the state of the art. Even the logo’s design — two words drawn in informal script inside an imperfect circle created by the art director of White’s agency — conveyed a breezy straightforwardness.

While Intel promoted the Intel Inside logo in ads of its own, the campaign depended heavily on a cooperative endeavor in which the company provided subsidies to OEMs who included the logo on their own products and ads, thus encouraging consumers to think about the processors inside the devices they bought and recognize Intel as a sign of quality and innovation. By the end of 1992, over five hundred OEMs had signed onto the cooperative marketing program and 70 percent of OEM ads that could carry the logo did so.

Here's an old Intel Inside commercial for posterity. This one explains to customers the value of an Intel chip that can run boatloads of software; x86 lock-in was mutually beneficial for customers and Intel.

This symbol outside means you have the standard inside that an entire library of software has been written to. The Intel microprocessor – think of it as a library card that lets you run the software of today and tomorrow. So check out computers with Intel, the computer, Inside.

Strategy

Simple

In the spirit of a simple equation like Ohm’s law, we can summarize Intel’s strategy as a function of its manufacturing leadership, x86 lock-in, and brand.

While not a precise formula, this illustrates that any substantial decline in Intel's manufacturing capabilities, its stronghold on the x86 architecture, or its brand recognition could adversely affect its sales in client and data center segments.

Lighthouse

This perspective also illuminates the path for Intel's rivals.

Take AMD, for example. They've successfully leveled the playing field in terms of x86 compatibility and, thanks to TSMC, can even outrun Intel’s manufacturing team.

Yet Intel's brand remains an obstacle, especially in the client segment.

The question for AMD, thus, is how can they overcome this final hurdle in client?

Second-Order Effects

Note that Intel’s strategy function doesn’t depend on architectural design as a strategic differentiator for Intel. Consider design a second-order effect.

This might seem surprising. Aren’t all those computer architects and engineers super important? Yes, they are! Smaller transistors don’t mean anything without great design engineers who can use them as efficiently and effectively as possible.

Excellent architectural design is crucial for Intel’s competitiveness but is not a competitive advantage.

Wait what? A chip design company’s strategic advantage isn’t its chip design?

Yes, sorry engineers 😅

Here’s a simile: Starbucks is the largest coffee company in the world, but their competitive advantage is not coffee. Starbucks’ competitive advantages are its “third-place” atmosphere, the convenience of its mobile app, and the fact that you can go to nearly any city in the world and find the same consistent Starbucks experience.

Starbucks’ coffee only has to be good enough. Many competitors can make better coffee, but will struggle to compete with Starbucks’ physical footprint or brand.

In chip design, architectural innovations are valuable but are merely temporary leads — not durable competitive advantages.

This raises the question for technical startup founders: if your new architectural approach is merely a temporary advantage, then what’s your long-lasting differentiation?

Do you have any?

Mental Model + Differentiation

We can update our mental model to reflect Intel’s strategic differentiators:

Challenges

Intel executed on this strategy for many years, but has suffered from direct strategy hits in the past decade.

Manufacturing Falling Behind

It turns out Intel’s manufacturing horse wasn’t invincible after all. It lost one race, then another, and yet another.

The impact of these losses were amplified by manufacturing consolidation. Consumer products on a leading node chip built by TSMC or Samsung were improving faster than any products with Intel inside.

The industry was moving ahead while Intel was left behind.

These manufacturing stumbles were a direct hit to Intel’s strategy and caused sales declines and a weakened brand. The x86 lock-in advantage didn’t take a direct hit, but Intel’s x86 neutralizer AMD gained ground.

Uncompetitive Margins

Intel faced another significant challenge due to losing its manufacturing lead: reduced margins.

As a reminder, gross margins are a function of revenue and cost of goods sold.

gross margin % = (revenue - cost of goods sold) / revenue

As discussed earlier, a lagging node results in less competitive products which impacts sales volume. The loss of competitive chip performance reduces sales, which diminishes pricing power and impacts average sales price (ASP).

Losing the process race thus is a doubly-whammy for revenue: decreased volume and less price appreciation or decreased price.

As we see in the gross margin calculation above, rising COGS further squeezes margins. With lower sales volumes, the fixed costs associated with operating a massive fab get spread over fewer chips, driving up the per-unit cost.

COGS can also rise when an IDM doesn’t have proper checks and balances in place. Intel allowed design teams to make demands of the fab, like expedited orders, without bearing the financial burden of their decisions. This resulted in manufacturing inefficiencies and poor capacity allocation, ultimately impacting COGS.

Fabless companies, on the other hand, operate under strict financial constraints imposed by foundries, promoting disciplined decision-making.

New Strategy

To CEO Pat Gelsinger’s credit, Intel recognized that their existing strategy was no longer sound, and continuing to lose the process race would eventually prevent them from affording the next entry fee.

In response, Intel launched a major strategy overhaul centered around two key pillars

Regaining technology leadership

Adding structural accountability

Regaining Leadership

In 2021, Intel launched a plan dubbed “Five Nodes in Four Years” or 5N4Y.

This plan calls for Intel manufacturing to speed through five process node milestones as quickly as possible to reach the starting line where they believe they’ll be competitive. The five nodes are Intel 7, 4, 3, 20A, and 18A.

(The nomenclature is shifting from nanometers to Angstrom. 1n = 10 Angstrom. 18A is 1.8nm. Also the names don’t mean what they used to anyway.)

Yes, 5 nodes in 4 years sounds insane. After all, the earlier chart showed that it took Intel several years between nodes. How can they possible cram 5 into 4 years?

It would look something like this:

Some of these steps are arguably “half nodes”, or smaller intermediate steps. And Intel is getting creative and swallowing their pride — they’re even sending some components off to TSMC for fabrication. If manufacturing executes carefully and Intel has a ton of money for each entry fee, this plan should be possible.

Regardless of the semantics of whether it’s 5 (half?) nodes or 2 full nodes, the plan is clear, and Intel has milestones to hit which will demonstrate progress for employees, customers, and Wall Street.

Structural Accountability

There’s another problem: costs.

With Intel’s old approach, the manufacturing group didn’t have its own profit and loss (P&L) but was instead a cost center. This resulted in a lack of transparency; without a proper P&L, it was not as easy to observe excessive costs, compare Intel’s manufacturing to external foundries, or align incentives appropriately across design and manufacturing.

Intel recently outlined a new approach to overcome these concerns.

The manufacturing group, Intel Foundry Services (IFS), now has its own P&L.

IFS will treat the design team the same as an external customer from an accounting perspective, yet still maintain the tight co-design relationship benefit of teammates.

This gives transparency, enables benchmarking against other foundries, and properly incentivizes the design team to be more disciplined. If design wants a rushed order, they’ll have to pay for it.

Intel calls this strategy IDM 2.0.

The strategic shift also aligns IFS with the number one goal for any fab: fill the fab.

This utilization mantra stems from the massive fixed costs associated with building and operating a fab; chips are cheaper when there’s more of them.

As Intel's volume diminishes, it struggles to fill the fab, and external customers become increasingly necessary to maintain operational efficiency.

Of course, the extra revenue is welcome too.

Although Intel's foundry is not yet on par with leading competitors in terms of fabrication technology, it's leveraging its advanced packaging capabilities to secure early customer wins. This approach involves packaging chips or chiplets manufactured at other foundries. Intel sees this as a stepping stone towards attracting customers for its fabrication services in the future when it reaches 18A.

Finally, IFS gives Intel a sort of strategy credit: it has the geopolitical advantage of being a semiconductor manufacturer based in the USA. Come partner with IFS, we’re US-based!

This competitive advantage is already evident with the CHIPS Act, which has provided substantial funds for Intel to further invest in IFS.

Updated Mental Model

We can create a new simple mental model that accounts for IDM 2.0 changes:

Up Next

In a future post, we’ll use this model to investigate Intel’s lousy Q2 2024, which included a surprise 15,000-employee layoff.

Intel has a seemingly sound new strategy. What went wrong?